Allocation of Mid Cap & Small Cap Funds

In Mutual Fund Investments, mostly we consider category wise funds in our portfolios like large cap, mid cap, small cap.

In general, it’s been discussed, shared and informed by various financial experts that mid cap & small cap are investments for long-term.

Indeed that’s true, but I want to add that Equities as an investment product is meant for the long-term only. Now, what do I mean by long-term? And what type of money you should Invest in It?

You should invest only that amount in equity mutual funds, that you will not require in less than the next 10 years at least.

Categorization of Mutual Funds based on Market Cap

- Large Cap Funds

- Mid Cap Funds

- Small-Cap Funds

- Flexi Cap Funds

These categories should not be considered based on Time Period of your Investments, it should be considered based on your risk profile.

You may not be comfortable with higher volatality even if your time horizon is 20 years, hence you should not consider mid cap or small cap funds based on just time horizon because they tend do be highly volatile than other two.

Major Indices of These Categories

- NIFTY 50 (For Large Cap)

- NIFTY 500 (For Flexi Cap)

- NIFTY Midcap 150 (For Mid Cap)

- NIFTY Smallcap 250 (For Small Cap)

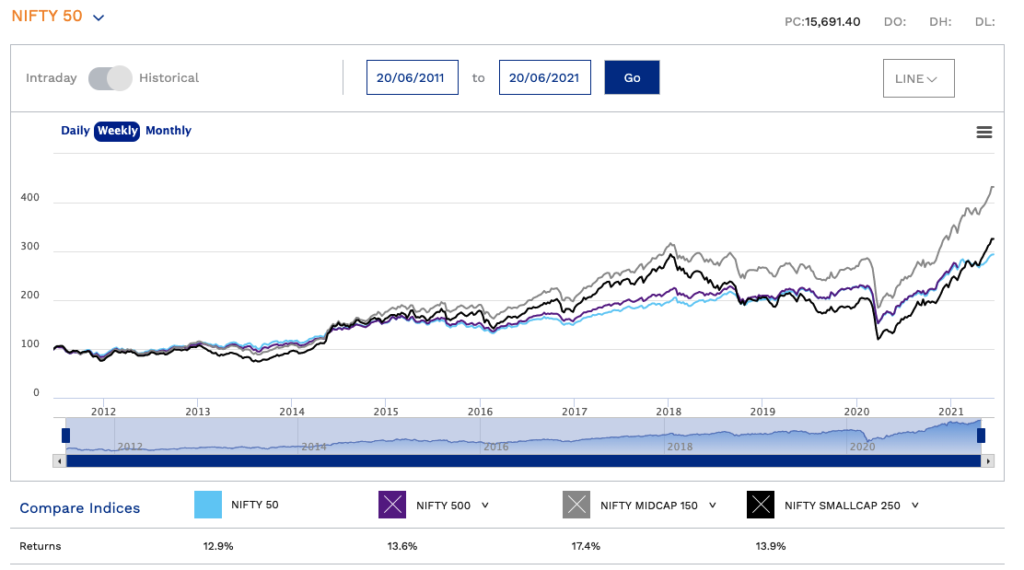

Performance of Major Indices

Let’s see how these Major Indices have performed over different time periods.

15 Year Time Period Performance

In last 15 Years, NIFTY 50 delivered 12.9%, NIFTY 500 delivered 13.1%, NIFTY Midcap 150 delivered 15.5% & NIFTY Smallcap 250 delivered 13.1%.

As you can see in this time period NIFTY Midcap 150 outperformed others by delivering returns of 15.5%, but NIFTY Small Cap 250 delivered 13.1% only which is the same as NIFTY 500.

10 Year Time Period Performance

In last 10 Years time period NIFTY 50 delivered 12.9%, NIFTY 500 delivered 13.6%, NIFTY Midcap 150 delivered 17.4% & NIFTY Smallcap 250 delivered 13.9%.

NIFTY Midcap 150 outperformed others again in 10 years time period by delivering returns of 17.4%.

Relation Between Risk & Return

NIFTY Midcap 150 has over delivered in both time frames doesn’t make it an attractive investment for the future, with high returns comes higher volatility too.

As you can see in the charts that mid-cap and small-cap are very volatile also they rallied rapidly in 2017 and then suddenly falls in 2018 – trying to time these levels is like jumping from the mountains.

On the other side, NIFTY 50 & NIFTY 500 were less volatile and delivered similar returns as of NIFTY Smallcap 250.

My Conclusion

Don’t fall for this that mid-cap and small-cap are only for the long term, so if your time period is 20 years doesn’t mean your allocation into these categories of funds should be high.

The time period has nothing to do with better performances of the categories. Smaller companies have more volatility in their stock prices, resulting in higher volatility of their indices and their fund’s category.

Allocation to these categories should be strictly based on your risk profiling.

For example, if you are an aggressive category of investor who has a good understanding of market volatility and how you can benefit from the opportunities given by the market.

In that case, you should allocate more into mid-cap and small-cap funds and invest more when valuations of these categories become attractive, your turnaround time in these categories can also be more than the large-cap or Flexi cap.

Remember, though there is a higher probability of performing better by being an aggressive investor, there’s no guarantee of higher returns as your control over behavior and taking the right decision in investing also plays vital roles.

In that case, you can hire a professional who can guide you from time to time and handhold you from making irrational decisions.

* * *

If you like this post, please do share it with others, and also Click here to Subscribe to my FREE Email Newsletter.

Hi, I’m Managing Director at Gurpreet Saluja Financial Services Pvt. Ltd. Where I help my investors to invest in mutual funds and achieve their financial goals. I’m also a Value Investor and here I write about Personal Finance & Investing.