Analyze Your Financial Position With Financial Statement

Let’s learn how to your make your own financial statement to analyze your financial position, so that you can make your plan to become debt free and start building your wealth.

So as discussed the very first thing you need to do to get out of your debt is, to make your own financial statement because you must know your current financial position before you proceed further.

To help you out making your personal financial statement, I have made an excel format of a financial statement. You can download the format for a financial statement and fill it with all your details. Download Here

What Is Financial Statement?

Financial Statement is basically a statement which describes your financial position, it includes a income column, expenses column, asset and liabilities columns to help you know your own financial status.

I have designed this financial statement in an excel format to reduce your workload.

After downloading open the blank financial statement in excel, now I will explain you how to fill up this financial statement (I have also added comments in excel sheet).

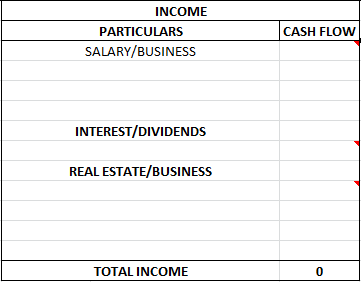

Let’s start with Income Column..Here is how it looks!

In Income column you need to list all your incomes, Incomes are further divided into three types – Ordinary, Portfolio and Passive, we will learn more about them later.

Salary/Business – Here you need to fill your monthly income i.e. salary, business income etc.

Interests/Dividends – Here you need to enter the interest and dividends you receive on loans or shares you have bought.

Real Estate/Business – List here your monthly income from real estates (this is also known as passive income).

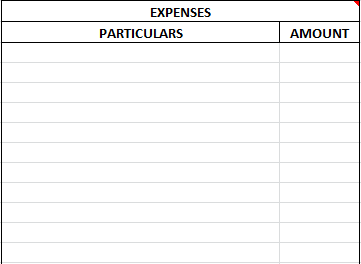

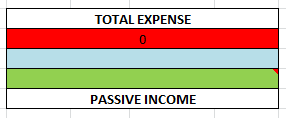

Now let’s get into expenses column…

In expenses column list down all your expenses – sit down and write each and every expenses weather you spend on even buying a Rs. 5 pen from stationary add it in your expenses by making a Misc. Expenses head under expenses column.

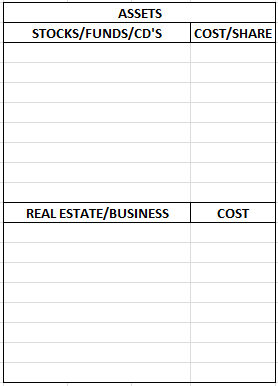

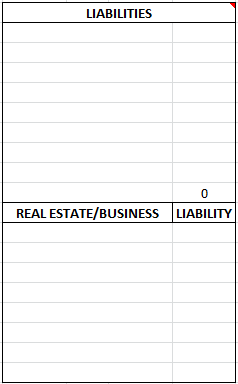

After expense column, you will see balance sheet which have assets and liabilities column to help you analyze your actual debt and wealth.

In this asset column, write down all stocks, mutual funds and cash deposits you have in your portfolio. Also, write down your real estate and the businesses you own.

On the liability side write down all your liabilities – debts/loans, overdue payments and also the real estates and businesses that you owe on a liability.

This explains about the status of how much deep you are in the rat race, these figures will update automatically to help you analyze better.

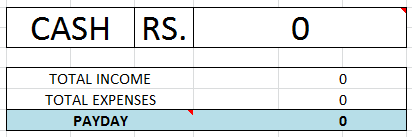

In this section all you need to update is just the cash balance you have, and you will also know how much actually money surplus you are having each month (if positive) or shortage of money you are having (if negative).

So, in this way you can analyze your financial position, I hope this financial statement will help you to analyze your financial position better.

If you have any query then tweet me @gurpreet_saluja.

Hi, I’m Managing Director at Gurpreet Saluja Financial Services Pvt. Ltd. Where I help my investors to invest in mutual funds and achieve their financial goals. I’m also a Value Investor and here I write about Personal Finance & Investing.