Data Patterns (India) Limited – IPO Analysis

Data Patterns (India) Limited is among the few vertically integrated defense and aerospace electronics solutions provider catering to the indigenously developed defense products industry. Their offerings cater to the entire spectrum of defense and aerospace platforms – space, air, land, and sea.

The company’s core competencies include electronic hardware design and development, software design and development, firmware design and development, mechanical design and development, product prototype design and development, functional testing and validation, environment testing and verification, and engineering service opportunities.

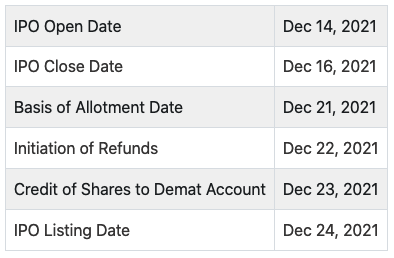

Data Patterns IPO Tentative Timetable

The Data Patterns IPO open date is Dec 14, 2021, and the close date is Dec 16, 2021. The issue may list on Dec 24, 2021.

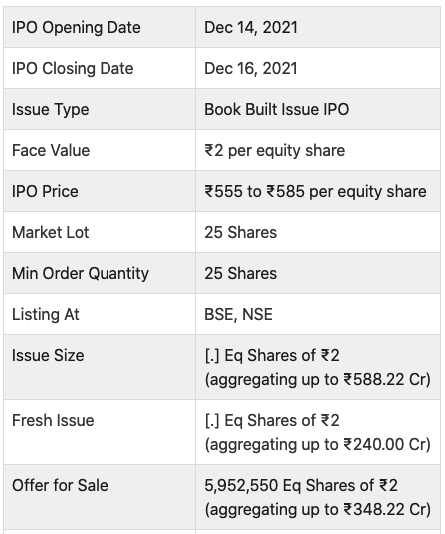

Data Patterns IPO Details

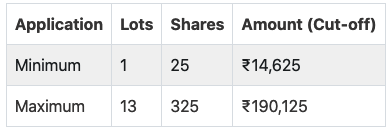

Data Patterns IPO Lot Size

The Data Patterns IPO market lot size is 25 shares. A retail-individual investor can apply for up to 13 lots (325 shares or ₹190,125).

Product Portfolio

- Surveillance Radar

- Weather Radar

- Wind Radar

- Tracking Radar

- BrahMos Missile

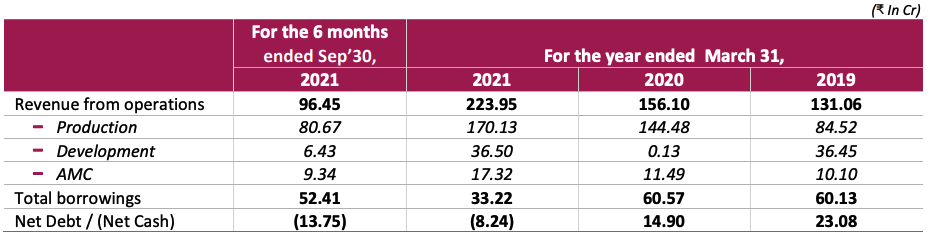

Financial Highlights

Objects of the Offer

The company has the following objectives behind raising money from the fresh issue of shares:

• Prepayment or repayment of all, or a portion, of certain outstanding borrowings availed by the company (60.80 Crores)

• Funding working capital requirements of the company (95.19 Crores)

• Upgrading and expanding the existing facilities in Chennai (59.84 Crores)

• General corporate purposes (To be determined)

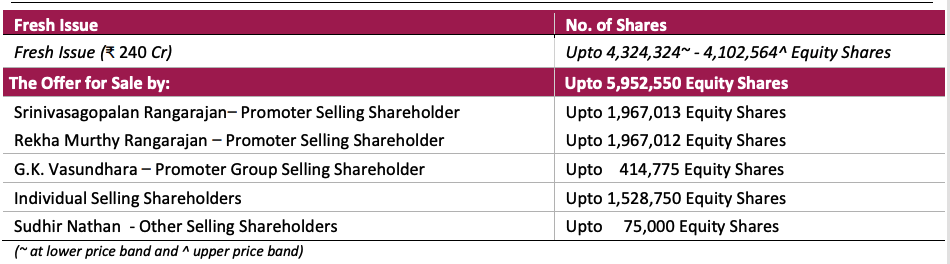

Offer Details

Strengths

- Strong customer base ✅

- Specialized product segment ✅

Weakness

- Dependency on limited customers ❌

Opportunities

- Make in India initiative 😇

Threats

- Intense competition 😰

- Inability to garner incremental order book 😰

* * *

If you like this post, please do share it with others, and also Subscribe to My YouTube Channel.

Disclaimer: This IPO Analysis is for education purposes only, this is not any recommendation to apply or investing in this IPO, Investment in Equity Markets are subject to market risks, read all IPO-related documents carefully before investing. Past IPOs Performance may or may not sustain in the upcoming IPOs. This Analysis was done on 13-Dec-2021 using the data source from Chittorgarh, Axis Securities Report, Stock Edge Reports, etc.

Hi, I’m Managing Director at Gurpreet Saluja Financial Services Pvt. Ltd. Where I help my investors to invest in mutual funds and achieve their financial goals. I’m also a Value Investor and here I write about Personal Finance & Investing.