How Franklin India Debt Funds Winding Up Will Impact You?

In the investment world where all the retail & institutional investors invest to grow their capital or to protect their capital by investing in assets like equity & debt.

Mutual Funds are a tool that is used by these investors to invest their capital. In India, during this corona led lockdown the liquidity issues were at their peak that impacted the debt market liquidity to its core.

As a result, this made one of the leading asset managers in India to take a step that was never taken in history. Yes, Franklin India Mutual Fund decided to wind off its 6 Debt Mutual Fund Schemes on April 23, 2020, which means investors can’t make any purchase or redemption in these schemes and these schemes will now completely wind up.

Now let’s understand a few things that will clear you that What actually happened, Why that happened, and What will happen now?

What Actually Happened?

As the officials of Franklin AMC say, that these schemes were facing a huge redemption pressure that they were unable to liquidate the portfolio at reasonable prices also they peaked out their net borrowing limits to fulfill redemptions, so this leads to the winding-up these 6 schemes by their management.

Why This Happened?

Well, to fulfill redemptions they had no cash available in these funds, no more borrowings allowed, no more near term maturity of bonds in portfolios also not able to sell bonds in the secondary market as they were not getting the reasonable prices to sell those bonds in the market.

If they are pressurized to sell the bonds at market prices this would have been lead to capital erosion by 10%, 20% or more you never know therefore capital erosion in debt funds that too just because of force selling to fulfill redemptions would be an unfair decision for the investors who would want to continue with their investments.

So this happened to protect the investors as a whole, this was by far the best decision they could take considering the situation they were in.

What Will Happen Now?

Well, the Franklin India proposed that they will return back the investors money in these funds as per their Maturity Profile means as the funds will receive the maturity amount of bonds in which they have invested in, will be further passed on to the unitholders.

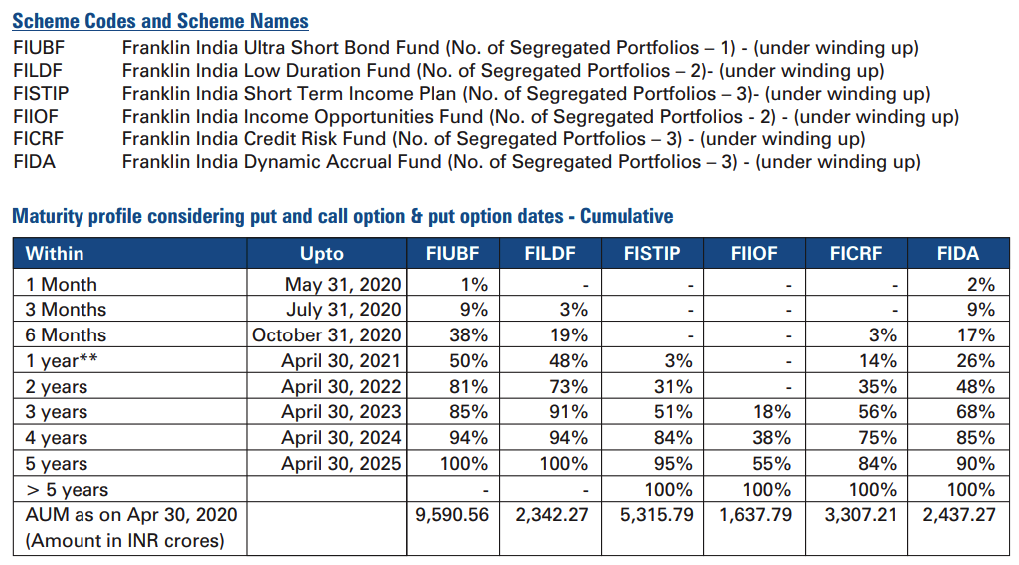

So as per the latest release of portfolio holdings of these schemes and their maturity profile, this is how the scheduled maturity timeline of these 6 schemes looks like

As per this maturity profile timeline, if you have your investments in Franklin India Ultra Short Bond Fund you will cumulatively receive 50% of the investments by April 30, 2021, and another 31% by April 30, 2022, and remaining till April 30, 2025.

The following points that you as an investor must know which Franklin India mentioned while putting up this data:

- The percentages have been computed considering the total of all amounts receivable less the outstanding borrowings, as the base

- Net Asset Value per unit will continue to be computed and declared as per the same accounting and valuation principles as done prior to April 23, 2020, without any change

- For perpetual bonds, the immediately forthcoming call date is considered as the maturity date

- The data excludes any recovery from segregated portfolios. Receipt of interest and principal repayments from segregated portfolios will accordingly increase the payout to investors of the segregated portfolio

- Interest income is not considered in the projections. Receipt of coupons will add to the cash flows and accordingly increase the payout to investors.

For a better understanding of the portfolio that your scheme holds you can refer to this latest portfolio holding report of these 6 schemes shared by the Franklin India on their website, links to which I have provided at the end of this post in Resources Section.

Our View on This Franklin India Debt Funds Episode

Well, most of the investors who have their investments in these funds are panic about the decision of winding up these 6 schemes, they are somewhere losing reliability when it comes to investing in debt mutual funds or specifically the mutual funds of Franklin India which is not true.

As sensible investors and rational thinkers, we need to understand the matter carefully before making any of the decisions out of panic or creating a buzz all around us.

Personally we feel this is the best they could do to safeguard their existing investors – So if you’re among those investors who didn’t want to redeem your investments in this phase or say the next 2 – 3 years they have taken this decision to safeguard your capital.

And if you are the one who was in need of the money in the coming 1 or 2 months that you have invested in these schemes, then this is the worst thing that happened to you.

This is the best balance they could have made by this decision. But, you need to have the facts clear that you have not lost your money to Franklin India Mutual Fund – which the anti-media or peoples are buzzing about.

It is just that you will not be able to liquidate all your money instantly, you will be receiving the money in parts as per the maturity profiles of these schemes.

So, you don’t need to get panic, you will receive your money back as per the timelines, you have not lost all your money, it is being tried to safeguard and return you in the earliest manner possible by the AMC.

Panic is not any solution in this type of scenario where we are also facing the corona pandemic, I understand it is about our hard-earned money but it is also about accepting what has happened and to decide further what to do instead of panic of losing money which you have not lost.

Resources:

Hi, I’m Managing Director at Gurpreet Saluja Financial Services Pvt. Ltd. Where I help my investors to invest in mutual funds and achieve their financial goals. I’m also a Value Investor and here I write about Personal Finance & Investing.