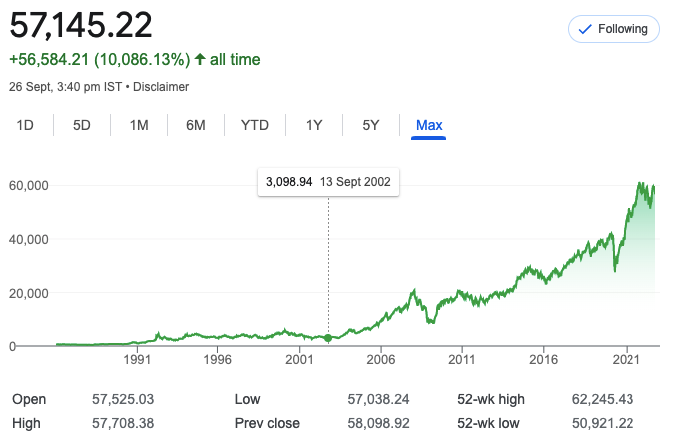

SENSEX Performance In 10 Years

Retail investors investing via Equity Mutual Funds in the markets often fall prey to one of the investment biases – Recency Bias.

Recency Bias is making decisions based on recently occurred events. Say, Markets started rising people will start investing more in the markets because the market performed well in the past, and when markets started falling they will wait or redeem thinking markets are not doing good.

But what is the ultimate reality? How one should invest if not based on recent events?

When to Invest in Equity?

Well, the very first thing we need to understand is that equity is for at least 10 years, not for the coming 1 or 2 years. If you don’t have plans to remain invested for at least 10 years, then better don’t invest in equity.

If your focus is compounding and wealth creation by earning inflation-beating returns then regular investments through SIP in Equity Mutual Funds is the best way.

Now irrespective of different data points, logic, emotions, facts, politics, and outlooks.

Let’s see how markets have performed in the last 20 years on 10-year periods.

SENSEX from 2002 to 2012

In Sep 2002 the SENSEX was trading around 3098.94 and in Sep 2012 the market was trading at 18,762.74 delivering an annualized return of 19.63% in these 10 years.

SENSEX from 2012 to 2022

In Sep 2012 markets were at 18,762.74 and today as of 26th Sep 2022 SENSEX is trading at 57,135.22 delivering an annualized return of 11.78% in the last 10 years.

SENSEX Performance in 10 Years

As you can see markets delivered phenomenal returns in the 2002-2012 period and in the 2012-2022 period as well, so if we have to expect the markets to perform even at the worst of 10% annualized returns in the coming 10 years, then the value of SENSEX would be around 1,48,140 levels.

So if markets are going to deliver in 10 years, why do we worry about performances in 1 or 2 years? There’s no logic to seeing your portfolio again and again and calling yourself a long-term investor.

Investors, those who compounded their wealth multiple times, have never seen the performances in decades. They just believed in India, believed in its Equity, and kept on Investing in it via SIP.

Click Here to Start Your SIP in Mutual Funds with Us.

Disclaimer: Above projected figures of SENSEX are calculated at 10% annualized returns and not a guarantee of returns. Mutual Fund Investments are subject to market risks. Read all scheme-related documents carefully before investing.

Hi, I’m Managing Director at Gurpreet Saluja Financial Services Pvt. Ltd. Where I help my investors to invest in mutual funds and achieve their financial goals. I’m also a Value Investor and here I write about Personal Finance & Investing.