Story of a High NAV Fund

Many Mutual Fund Investors still have doubt in their mind that a High NAV Fund grows less than a lower NAV Fund. They ask, a Fund NAV has already risen so much what more it can rise?

This analogy is incomplete because most of us look only at the single parameter that is ‘Price’.

When it comes to investing in Mutual Funds, you have to look at the fund category and risk profile then you have to match fund suitability with your own risk profile. There is nothing to do with High or Low NAV, Why? Let’s understand

Story of a High NAV Fund

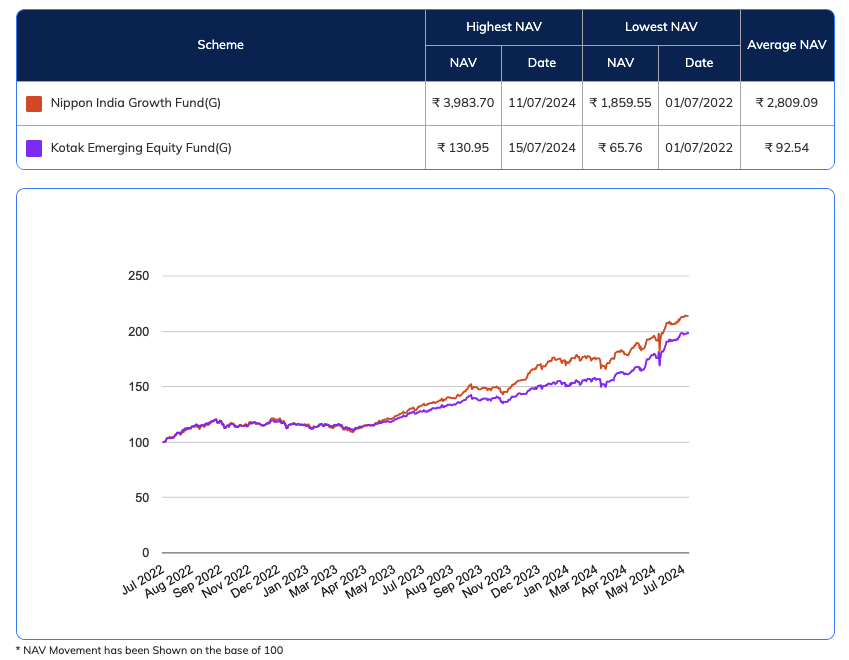

2 years back in Jul 2022 I was discussing investments with one of my investors and I decided to allocate some amount in the Midcap Category Fund I suggested Nippon India Growth Fund-Reg-Gr to him based on his risk suitability.

Then he had a few queries to me, What is the Current NAV Fund? What is the Portfolio of the Fund? What is the recent performance of the fund? I said sure, then I shared all these 3 data with him.

Then he had another question, “Gurpreet, why do you want me to invest in a Fund, whose NAV is already ~1800 levels, what more this fund will grow now?”

I told him that Fund NAV has nothing to do with its growth, because a Mutual Fund is a portfolio of different stocks, the way those stock prices will rise the fund NAV will grow based on that, the fund’s own NAV has nothing to do with its performance.

For example, “A Midcap Fund with a NAV of Rs.18 and another Fund with a NAV of Rs.1800 – If a Midcap Category grows by 10% the Rs.18 NAV will increase by Rs.1.8 to Rs.19.80 and another fund with NAV of Rs.1800 will increase by Rs.180 to Rs.1980 – so you can see the growth in % terms will remain same.”

Yesterday (15 Jul 2024), the NAV of Nippon India Growth Fund – Reg – Gr closed at Rs.4008.3291 so you can see a ~1800 NAV fund in Jul 2022 has today grown to ~4000 levels in Jul 2024. This is how growth in a fund works – there is nothing to do with NAV.

Similarly, in Jul 2022 the NAV of another Midcap Fund – Kotak Emerging Equity Fund – Reg – Gr was at ~Rs.65 levels, and on Jul 15, 2024, it closed at Rs.130.9450 which also gave similar returns despite its NAV 2 years back was in double-digit only.

So, when you are investing in a mutual fund scheme you have to see its risk suitability with yours and then portfolio and other parameters, price is not the right parameter to make your investment decisions.

Do let me know if you still have any doubts or queries, and If you want to Start SIP in Mutual Funds, then Click here to Start SIP.

* * *

If you like this post, please do share it with others, and also Subscribe to My YouTube Channel.

Hi, I’m Managing Director at Gurpreet Saluja Financial Services Pvt. Ltd. Where I help my investors to invest in mutual funds and achieve their financial goals. I’m also a Value Investor and here I write about Personal Finance & Investing.