The Wonders of Additional Returns

Everyone wants to earn additional returns on their savings, investments and even on the time they spent on something.

Apart from that while making any purchase or spending money everyone wants a discount too (that’s also sort of additional returns).

Now, What Wonders additional returns can do in next 10 years?

You will have 70 Lakhs if you continue to save Rs.50,000 every month in your savings account generating 3% CAGR.

You will have 82 Lakhs if you continue to save Rs.50,000 every month in your Bank Recurring Deposit generating 6% CAGR.

You will have 1.03 Crores if you continue to save Rs.50,000 every month in an equity mutual fund generating 10% CAGR.

A Recurring Deposit can give you additional Rs.12 lakhs from saving account and an Equity Mutual Fund can give you an additional 33 Lakhs from saving account.

Now, you may say equity mutual funds are risky than the recurring deposit or savings account.

Let’s look how the equity mutual funds in multicap category performed in the last 10 years.

| Scheme Name | 10 Yr Returns |

|---|---|

| Kotak Standard Multicap | 12.31% |

| UTI Equity Fund | 12.10% |

| ABSL Equity Fund | 11.83% |

| Canara Robeco Equity Diversified | 11.29% |

| SBI Magnum Multicap | 11.27% |

This is how the funds in Multicap Category performed in the last 10 years whereas the S&P BSE 500 TRI Index delivered 8.24% CAGR.

What Is The Risk of Investing In Equity Mutual Fund?

There are majorly two risks that you need to check through if you can sustain that or not before investing in an equity mutual fund.

If you feel you don’t have the risk appetite to go through these two risk factors then you should not invest in an equity mutual fund.

- Low or No Returns During Initial Years.

- Have to see Portfolio Down from its Peak during the Bear Phases.

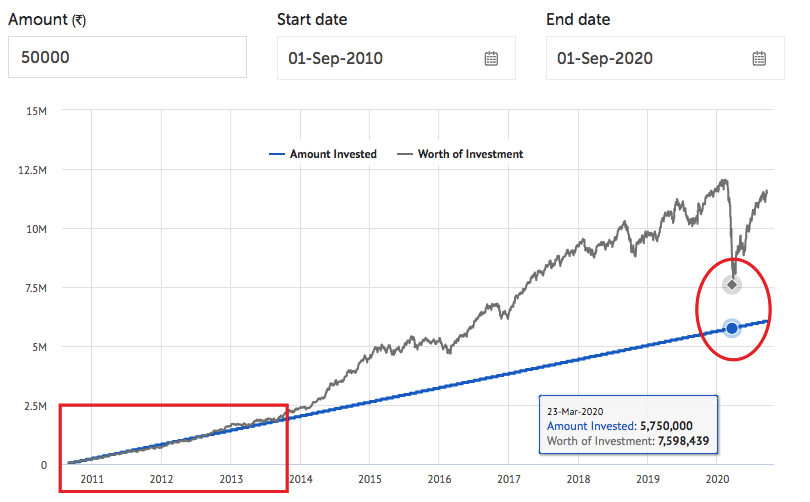

This is how the same thing happened with Kotak Standard Multicap Fund during the last 10 years. (see the chart below)

As you can see, if you would have started SIP in 2010 then you have seen no or very low returns during the initial 4 years and then the returns started picking up and you could see huge gains than the amount invested.

Secondly, you have seen the fall in the value of your fund during the bear phase when the market crashed due to Corona Pandemic in March 2020.

But in both cases, you don’t lose much if you stay patient and remain invested rewards are at your favor.

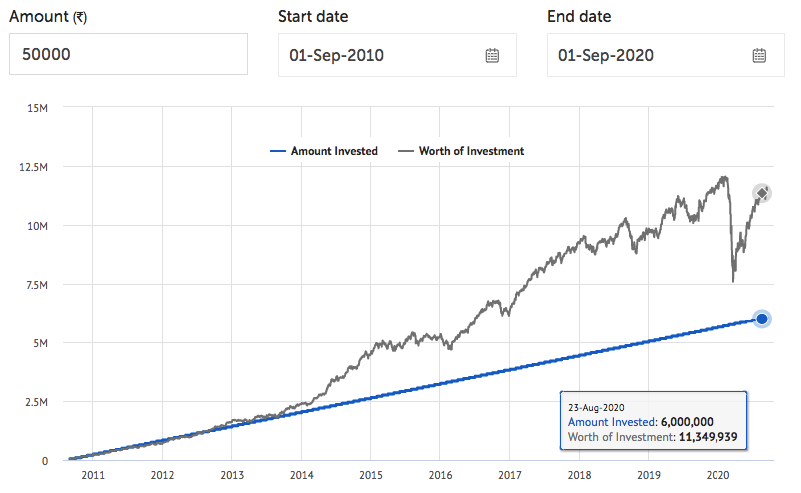

Here’s how the current value looks like post the pandemic period.

You would have now Rs.1.13 Crores if you invested Rs.50,000 in Kotak Standard Multicap regularly from the last 10 years. Of course, you had to sustain both the above-mentioned risks to achieve this.

If you can do so, then the equity mutual funds are the best option for you to accumulate a corpus for the next 10 years too.

Remember, If you are investing systematically Your behavior plays a 90% role in accumulating such corpus 10% is the role of suitable scheme selection.

Hope this helps, Have a wonderful journey of additional returns.

Disclaimer: Mutual fund investments are subject to market risks. Please read the scheme information and other related documents before investing. Past performance is not indicative of future returns. Mutual Fund Schemes mentioned in the blog is not a recommendation to buy. Please consider your specific investment requirements before choosing a fund that suits your needs.

* * *

If you like this post, please do share it with others, and also Subscribe to my weekly newsletter below.

Hi, I’m Managing Director at Gurpreet Saluja Financial Services Pvt. Ltd. Where I help my investors to invest in mutual funds and achieve their financial goals. I’m also a Value Investor and here I write about Personal Finance & Investing.