Top 5 Large Cap Funds Rolling Returns Analysis

Large-cap mutual funds are popular choices for saving money and investing for the future. They invest in big companies and can help your money grow over time. In this article, we’ll look at the top 5 large-cap mutual funds and see how they’ve performed using rolling returns.

What Are Large-Cap Mutual Funds?

Large-cap mutual funds are like a basket of stocks from big companies that are well-known and established. These companies are usually very stable and have a good track record. Investing in these funds is a way to buy a small piece of many large companies at once, which can reduce risk.

What Are Rolling Returns?

Rolling Returns represents the annualized return for a specific investment period – “Rolling Return Period (say, 5 years), calculated by looking at different starting and ending dates (each matching 5 years) at a daily frequency, each falling between the entire “Period To Study.”. Thus, there would be multiple 5-year returns during the period of study.

Rolling returns provide a broader picture of the fund’s performance consistency over time (covering all ups & downs) compared to Point-to-Point returns (lump sum) which show a single return from a specific date to a specific date.

Top 5 Large Cap Mutual Funds

Here we will give you an analysis of the Top 5 Large Cap Funds based on different rolling return parameters for 5 Years.

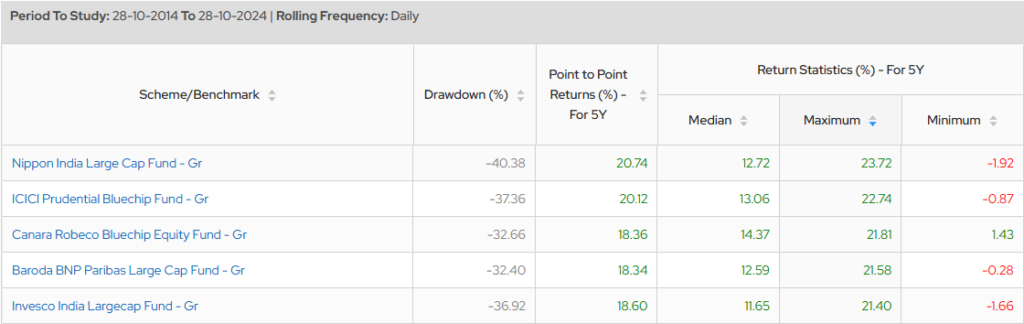

We prepared a report on the rolling return of the Large Cap Category of Funds where we took Rolling Returns of 5 Year Period and the Period to Study was from 28th Oct 2014 to 28th oct 2024, Rolling Frequency as Daily.

Below are the Top 5 Large Cap Funds based on Maximum Rolling Return Statistics (%) for 5 Years.

- Nippon India Large Cap Fund – Gr

- ICICI Prudential Bluechip Fund – Gr

- Canara Robeco Bluechip Equity Fund – Gr

- Baroda BNP Paribas Large Cap Fund – Gr

- Invesco India Large Cap Fund – Gr

Download the Full Excel Report

Let’s understand the Parameters first before doing further analysis (note this analysis is purely based on past rolling returns and not a guarantee of future performance as performances are based on the underlying selection of securities).

Drawdown

A drawdown in mutual funds is the decline in the value of an investment from its peak to its lowest point over a specific period. It helps you to understand the historical risk of an investment.

From the above 5 Listed Funds Baroda PNB Paribas Large Cap Fund (-32.40%) & Canara Robeco Blue Chip Equity Fund (-32.55%) had the least drawdown during the 5 years from their peak to their lowest point.

Point-to-Point Returns (%) For 5 Years

Point-to-point returns are the returns on an investment between two specific dates. It is used to measure the absolute return over the chosen period.

On Point-to-Point returns for a 5-year basis Nippon India Large Cap Fund (20.74%) & ICICI Pru Bluechip Fund (20.12%) delivered the highest returns as of 28th Oct 2024.

Median Rolling Returns (%) For 5 Years

Median Rolling Returns is the Average Rolling Return that the fund delivered for 5 Years from the Period of Study (28 Oct 2014 to 28 Oct 2024).

Canara Robeco Bluechip Equity Fund (14.37%) and ICICI Prudential Bluechip Fund (13.06%) delivered the highest Median Rolling Returns for 5 Years.

Maximum Rolling Returns (%) For 5 Years

Maximum Rolling Returns is the Highest Rolling Return that the fund delivered for 5 Years from the Period of Study (28 Oct 2014 to 28 Oct 2024).

Nippon India Large Cap Fund (23.72%) and ICICI Prudential Bluechip Fund (22.74%) delivered the highest Rolling Returns for 5 Years.

Minimum Rolling Returns (%) For 5 Years

Maximum Rolling Returns is the Lowest Rolling Return that the fund delivered for 5 Years from the Period of Study (28 Oct 2014 to 28 Oct 2024).

Canara Robeco Bluechip Equity Fund (1.43%) and Baroda PNB Large Cap Fund (-0.28%) delivered the highest Minimum Rolling Returns for 5 Years.

Overall Analysis

If you look at all the above Parameters only Canara Robeco Bluechip Equity Fund stands out as it might not have delivered the highest returns, but it still delivered highest median returns and highest minimum returns also the drawdown was among the lowest from these Top 5 Large Cap Funds.

Final Thoughts

Investing in large-cap mutual funds can be a smart way to grow your money over time. By looking at rolling returns, you can see how well these funds perform consistently. Remember, it’s important to choose a fund that fits your goals and how much risk you’re comfortable with.

Returns are not the only parameter for selecting funds because performance is based on underlying securities which may or may not change in the future. It is just to analyze how your fund is performing compared to its peers and past performance is not a guarantee of future returns.

Keep learning and asking questions. Make sure to Join My WhatsApp Broadcast in case you have still not joined!

Disclaimer: Mutual Fund Investments are subject to market risk, read all scheme-related documents carefully before investing. Past Performance may or may not sustain in the future. This Analysis was done on 28th Oct 2024 using the data source of Regular Plans from njwealth.in for educational purposes only. Kindly Consult to know your suitability before Investing. We are an AMFI Registered Mutual Fund Distributor.

Hi, I’m Managing Director at Gurpreet Saluja Financial Services Pvt. Ltd. Where I help my investors to invest in mutual funds and achieve their financial goals. I’m also a Value Investor and here I write about Personal Finance & Investing.