Top 5 Stock Picks This Diwali for Dividend Investing

Diwali is here and this Samvat 2079 List of Top 5 Stock Picks for Dividend Investing is also here.

Before moving ahead to get the details about the Top 5 Stock Picks, we need to understand first What is Dividend Investing and based on what criteria we have curated this list.

What is Dividend Investing?

Dividend investing is building a portfolio of businesses where you expect a regular distribution of their profits this will help you as an investor to build your cash flows which you can use to further buy other assets or for your consumption.

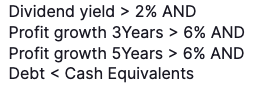

Top 5 Stock Picks This Diwali – Selection Criteria

We have shortlisted the businesses that have a dividend yield of more than 2% Profit Growth in the Last 3 Years of more than 6%, Profit Growth in the Last 5 Years of more than 6%, and most important where Debt is less than the Cash Equivalents means Virtually Debt Free Businesses.

Infosys Limited

Infosys Ltd provides consulting, technology, outsourcing, and next-generation digital services to enable clients to execute strategies for their digital transformation. It is the 2nd largest Information Technology company in India behind TCS.

Infosys Segment-Wise Revenue

Infosys’s 57% of Revenue comes from Digital Services which comprises services and solution offerings of the group that enables clients to transform their businesses and the remaining 43% of Revenue comes from, its Core Services which comprise traditional offerings of the group that includes application management services, proprietary application development services, etc.

Infosys has been distributing more than 40% of its net profit as dividends for the last 5 years.

| Company | Infosys Limited |

| Market Cap (In Crores) | ₹6,31,385 |

| Dividend Yield | 2.07% |

| 3 Years Profit Growth | 13% |

| 5 Years Profit Growth | 9% |

| Debt (In Crores) | ₹6,522 |

| Cash Equivalent (In Crores) | ₹14,869 |

| Source: Screener.in | As on 22 Oct 2022 |

ITC Limited

ITC is the largest cigarette manufacturer and seller in the country. ITC operates in five business segments at present — FMCG Cigarettes, FMCG Others, Hotels, Paperboards, Paper and Packaging, and Agri-Business.

ITC Limited – Segment-wise Revenues

- FMCG – Cigarettes (45% of revenue)

- FMCG – Others (28% of revenue)

- Hotels Business (4% of revenue)

- Agri-Business (13% of revenue)

- Paperboards, Paper & Packaging (10% of revenue)

ITC Limited has been distributing more than 50% of its net profit as dividends for the last 5 years.

| Company | ITC Limited |

| Market Cap (In Crores) | ₹4,28,516 |

| Dividend Yield | 3.33% |

| 3 Years Profit Growth | 6% |

| 5 Years Profit Growth | 8% |

| Debt (In Crores) | ₹253 |

| Cash Equivalent (In Crores) | ₹4,841 |

| Source: Screener.in | As on 22 Oct 2022 |

HCL Technologies Limited

HCL Tech is a leading global IT services company, which is ranked amongst the top five Indian IT services companies in terms of revenues.

HCL Tech Segment Wise Revenues

- IT and Business Services – 72%

- Engineering and R&D services – 16%

- Products & Platforms – 12%

HCL Tech recently distributed 84% of its net profit as dividends and since it’s on an asset-light model so is expected to distribute the majority of its net profits as dividends in the coming years.

| Company | HCL Technologies |

| Market Cap (In Crores) | ₹2,78,748 |

| Dividend Yield | 3.70% |

| 3 Years Profit Growth | 10% |

| 5 Years Profit Growth | 9% |

| Debt (In Crores) | ₹6,517 |

| Cash Equivalent (In Crores) | ₹10,568 |

| Source: Screener.in | As on 22 Oct 2022 |

Hindustan Aeronautics Limited

Hindustan Aeronautics is engaged in the business of Manufacture of Aircraft and Helicopters and the Repair, Maintenance of Aircraft and Helicopters.

HAL is a Core Aviation Equipment Supplier, HAL plays a strategic role in India’s defense program being the only Indian company having specialization in aircraft manufacturing and providing its Maintenance and related services.

HAL has been distributing more than 25% of its net profit as dividends for the last 5 years.

| Company | Hindustan Aeronautics Ltd |

| Market Cap (In Crores) | ₹80,338 |

| Dividend Yield | 2.08% |

| 3 Years Profit Growth | 29% |

| 5 Years Profit Growth | 14% |

| Debt (In Crores) | ₹48.6 |

| Cash Equivalent (In Crores) | ₹14,344 |

| Source: Screener.in | As on 22 Oct 2022 |

HDFC Asset Management Company Limited

HDFC Asset Management Company (HDFC AMC) is Promoted by HDFC Ltd (52.6% of shares) and abrdn Investment Management Limited (erstwhile known as Standard Life Investments Limited) – (10.2% of shares) is one of the largest AMCs in India with total assets under management (AUM) of 436338 Cr. as of Sep 2022.

HDFC AMC Segment Wise Breakup

- Equity – 51.4%

- Debt – 32.1%

- Liquid – 13.5%

- Others – 3%

HDFC AMC has been distributing more than 45% of its net profit as dividends for the last 5 years.

| Company | HDFC AMC |

| Market Cap (In Crores) | ₹44,146 |

| Dividend Yield | 2.03% |

| 3 Years Profit Growth | 14% |

| 5 Years Profit Growth | 20% |

| Debt (In Crores) | ₹0.0 |

| Cash Equivalent (In Crores) | ₹4.12 |

| Source: Screener.in | As on 22 Oct 2022 |

This Diwali If you are planning to do your investing in stocks with regular dividends, then do consider these businesses as part of your further research. Note: These Stocks list is just for educational purposes and not any sort of recommendation to either buy or sell securities.

Wish You a very Happy Diwali. 🪔

* * *

If you like this post, please share it with others, and also Subscribe to Our YouTube Channel.

Disclaimer: Equity Investments are subject to market risk, read all company-related documents carefully before investing. Past Performance may or may not sustain in the future. This List was prepared on 23-Oct-2022 using the data source from Screener.in for educational purposes only. Gurpreet Singh Saluja is an AMFI Registered Mutual Fund Distributor (ARN-107627) and not registered with SEBI for any stock related recommendations. Content Purely for educational purposes only.

Hi, I’m Managing Director at Gurpreet Saluja Financial Services Pvt. Ltd. Where I help my investors to invest in mutual funds and achieve their financial goals. I’m also a Value Investor and here I write about Personal Finance & Investing.