Where Indians are Investing Money?

Investing money to secure our lifestyle and old age from financials is important. Also, the decision to invest money is more important because that’s where most of us fail.

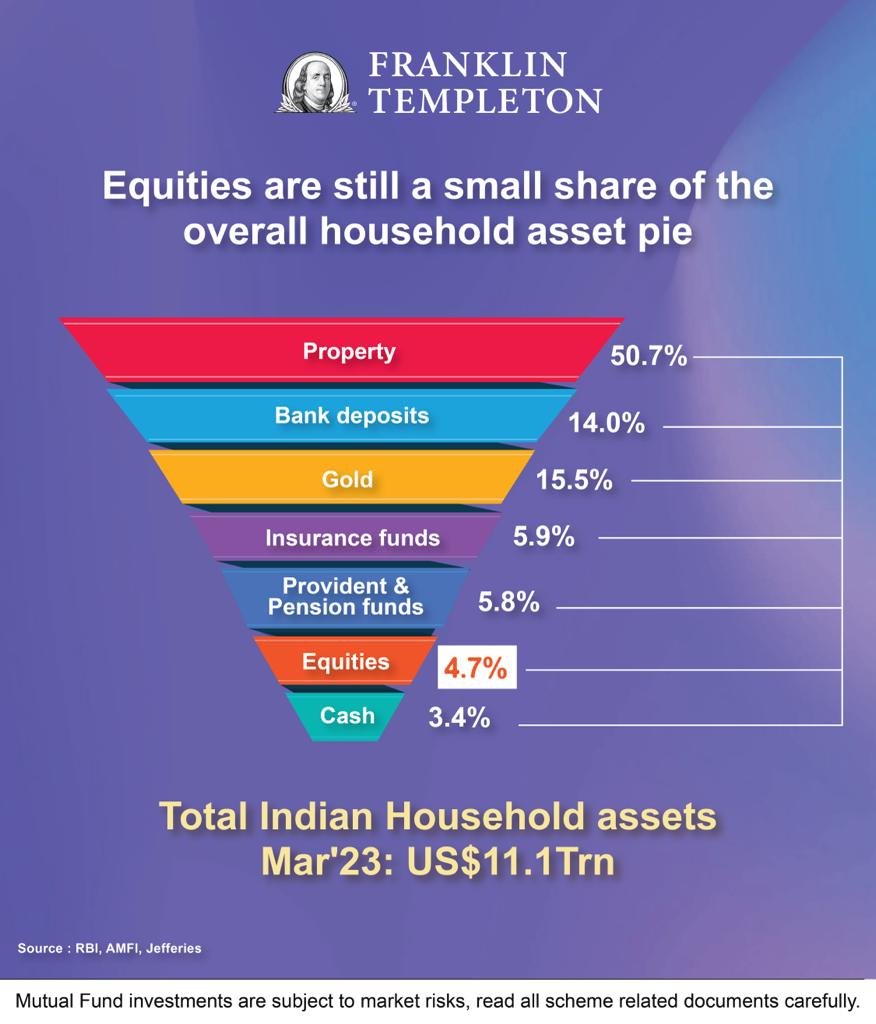

Just to give you a brief idea, I will share with you the data recently shared via an image from Franklin Templeton Mutual Fund to understand where the majority of Indian Households are Investing their Money.

Indian Household Investments March 2023.

As of March 2023 Total Indian Household assets were at US$11.1 Trillion from which 50.7% is currently Invested in Property, 15.50% in Gold, 14% in Bank Deposits, 5.9% in Insurance Funds, 5.8% in Provident & Pension Funds, 4.7% in Equities & 3.4% Cash.

As you can see, Equities (including Equity Mutual Funds) are still a small share of the overall household assets of Indians.

Equities have proven in the long run to be the most liquid as well as the inflation-beating asset. Still, Indian households have only 4.7% of their total assets.

However, this has significantly increased in recent years as investors have started understanding having inflation-beating assets in the long run to create wealth.

* * *

If you like this post, please do share it with others, and also Subscribe to My YouTube Channel.

Hi, I’m Managing Director at Gurpreet Saluja Financial Services Pvt. Ltd. Where I help my investors to invest in mutual funds and achieve their financial goals. I’m also a Value Investor and here I write about Personal Finance & Investing.