Why Investors Don’t Make Money in Equity Mutual Funds?

Investors try to control is their Return. The only thing that you as an investor can control is your Risk, Cost, Time, and Behavior, but you generally try to control returns that are not in your hands.

Prime Reasons Why Investors don’t make money in Equity Mutual Funds?

- Maximum money gets invested when markets are at unreasonable valuations.

- Investment happens on the cycle of Fear, Greed, and Hope.

- Asset allocation is preached rather than practiced.

- Perception and Reality of risk are inversely proportional.

- Investors make irrational decisions during times of euphoria and extreme fear.

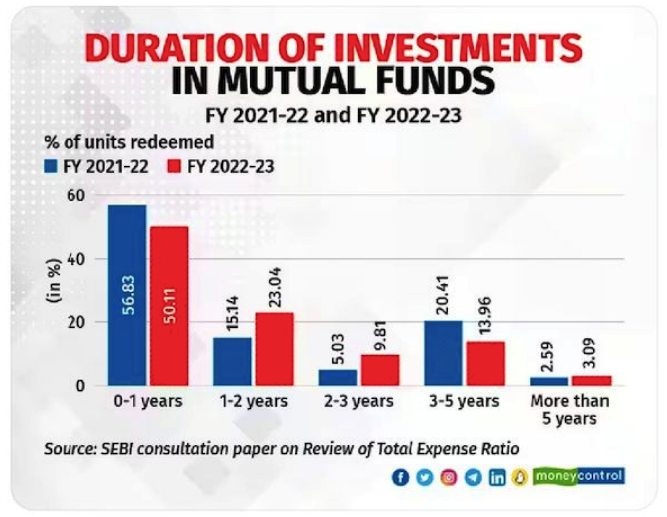

This data of FY2021-22 and FY2022-23 on the duration of Investments in Mutual Funds is very interesting to know the investor’s behavior, what they should vs what they actually do.

- ~72% of investors in Mutual Funds Schemes stay invested for less than 2 years.

- ~77% of investors stay invested for less than 3 years.

- Only ~3% of investors stay invested in a Mutual Fund Scheme for more than 5 years.

- Then the majority of investors who don’t stay invested keep on complaining that they didn’t build wealth in Mutual Funds.

The single most reason of investors not able to make money from equity is their own behavior and the way they take irrational decisions when it comes to investing in Equity Mutual Funds.

Be a better investor and understand what’s right and what’s wrong before taking any decision. If you need to discuss anything regarding your investments with me then click here to schedule a meeting with me.

Hi, I’m Managing Director at Gurpreet Saluja Financial Services Pvt. Ltd. Where I help my investors to invest in mutual funds and achieve their financial goals. I’m also a Value Investor and here I write about Personal Finance & Investing.