Your Urge To Invest In Stocks

These days when the stock markets are going up continuously compared to the levels of March 2020 it’s more than doubled in the last 1.5 years you might have urges to invest in stocks too.

The high returns on some individual stocks excite us because they have made huge returns in a short period of just 1 year. Here is a list of a few high return stocks of the last 1 year in India.

High Return Stocks In India (Nov 2021)

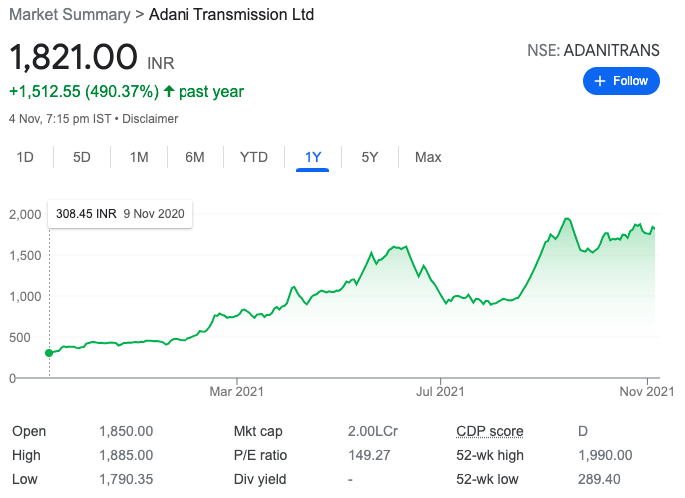

Adani Transmission Limited

Adani Transmission Limited delivered 490.37% returns in the last 1 year.

Adani Enterprises Limited

Adani Enterprises Limited delivered 315.48% returns in the last 1 year.

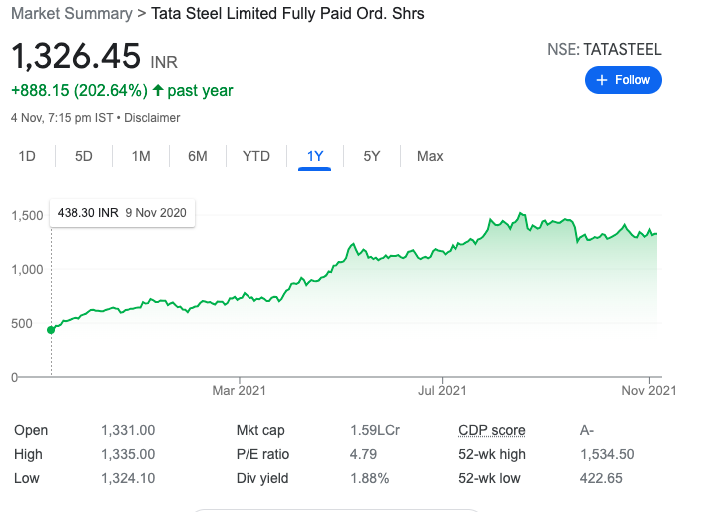

TATA Steel Limited

Tata Steel Limited delivered 202.64% returns in the last 1 year.

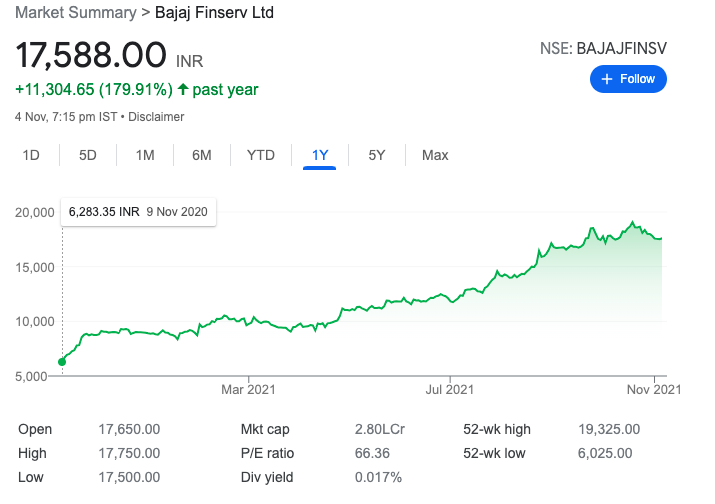

Bajaj Finserv Limited

Bajaj Finserv Limited delivered 179.91% returns in the last 1 year.

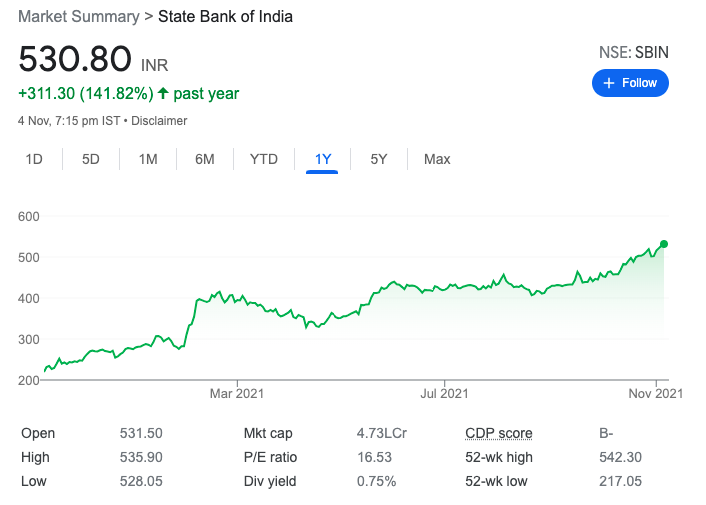

State Bank of India

State Bank of India delivered 141.82% returns in the last 1 year.

But, Was Journey Always So Delightful?

The answer is NO! The journey of investing in stocks directly was never always delightful, these stocks have gone through worse phases too.

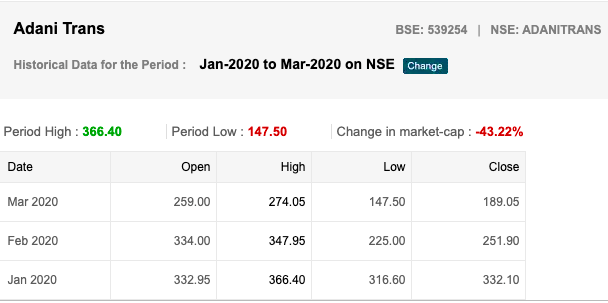

Adani Transmission Limited saw a -43.22% fall from Jan 2020 to March 2020. You might feel that for a 490% return it’s okay to see a negative portfolio of -43.22%, but in reality, it is easier said than done.

If you had invested Rs.10 Lakhs and you saw your portfolio at Rs.5.78 Lakhs that too when the whole world was going through a pandemic the first thing you might have done is withdraw what is remaining because you couldn’t have forecasted the future of Adani Transmission back in 2020.

Similarly, seeing current returns of 490% in 1 year will also urge you to enter into stock investing because you don’t want to miss the train. This is called FOMO (Fear of Missing Out).

What To Do?

Control your urge because money is not made on emotions, wealth can be created by systems and understandings, you can be lucky with emotions a few times only. Consistency comes with your skills in investing.

So, let’s come back to an Important Question, WHY? Why you should invest in Stocks?

✅ Because you have read Annual Reports of a Company

✅ Because you have read about the future of the industry to which that company belongs

✅ Because you have read the Financials of the company and they are improving significantly

✅ Because you want to own this company and reap benefits for at least the next 10 years

If you have the above reasons, then great you are good to go. Start investing in stocks you have researched. But always remember you should NOT invest in stocks if,

❌ NOT Because, Your Friend suggested it to you

❌ NOT Because, Some Expert on Social Media/TV wrote or talked about it

❌ NOT Because, It has delivered fantabulous returns and you believe it will give in the future too.

❌ NOT Because, It is in the news all the time

❌ NOT Because, You have heard about the company and you believe it cannot go bust.

Conclusion

These days, I completely understand watching your friends and on social media other people making money in stock markets urge you to invest too in stocks, but the end result for everyone never remains the same, nobody shares their losses they feel better to share only their profits so don’t fall to this when it comes to investing your hard-earned money.

Equity in the long term will definitely create wealth there is no doubt in it, but Invest in stocks only if you understand them else invest through Equity Mutual Funds only.

It’s your hard-earned money, let it grow all gradually and create wealth in years, don’t fall for short-term quick money hopes.

* * *

If you like this post, please do share it with others, and also Subscribe to My YouTube Channel.

Hi, I’m Managing Director at Gurpreet Saluja Financial Services Pvt. Ltd. Where I help my investors to invest in mutual funds and achieve their financial goals. I’m also a Value Investor and here I write about Personal Finance & Investing.